Top Trader Updates Outlook on Bitcoin and One New Ethereum Rival, Says This Crypto Asset Class Is Going to Zero

A popular crypto strategist is updating his outlook on Bitcoin (BTC) and one Ethereum (ETH) rival as he warns memecoins are likely to collapse.

Pseudonymous analyst Altcoin Sherpa tells his 195,100 Twitter followers that Bitcoin continues to lack a clear upward or downward trend and remains trading sideways.

According to his chart, Sherpa says Bitcoin has been chopping around in the $25,000 to $30,000 range for the past 48 days. The previous range Bitcoin chopped around in was between about $19,500 and $25,000 and that lasted 57 days.

“BTC: The problem for most traders the last six months is that there hasn’t been a continuous trending environment like in 2020 and 2021 (for alts). Lots of chop overall and just a few trending weeks followed by more chop. Know yourself and where to trade.”

Bitcoin is trading for $29,305 at time of writing, up 1.5% during the past 24 hours.

Also on the trader’s radar is the new layer-1 blockchain Sui Network (SUI).

Based on Fibonacci retracement levels, a method of technical analysis for determining an asset’s support and resistance levels, Sherpa believes SUI will revisit a lower range of $1.29. However, he warns if Bitcoin dips, SUI could drop down to $1.24.

“SUI: Expecting range lows to come eventually around $1.29, but it’s going way lower if Bitcoin shits the bed IMO (In my opinion). Still, it looks like somewhat accumulation phase as long as BTC is stable.”

Sui Network is worth $1.31 at time of writing, down 1.9% during the past 24 hours.

Next, the trader weighs in on skyrocketing Pepe (PEPE), a memecoin that launched last month. He warns Pepe and other meme tokens are likely going to collapse.

“PEPE derivatives are going to moon, aka all the other memecoins right now. But be warned; these are all going to go to $0 and will be short lived. Full on casino over the next few weeks IMO (in my opinion), same story as it always is.”

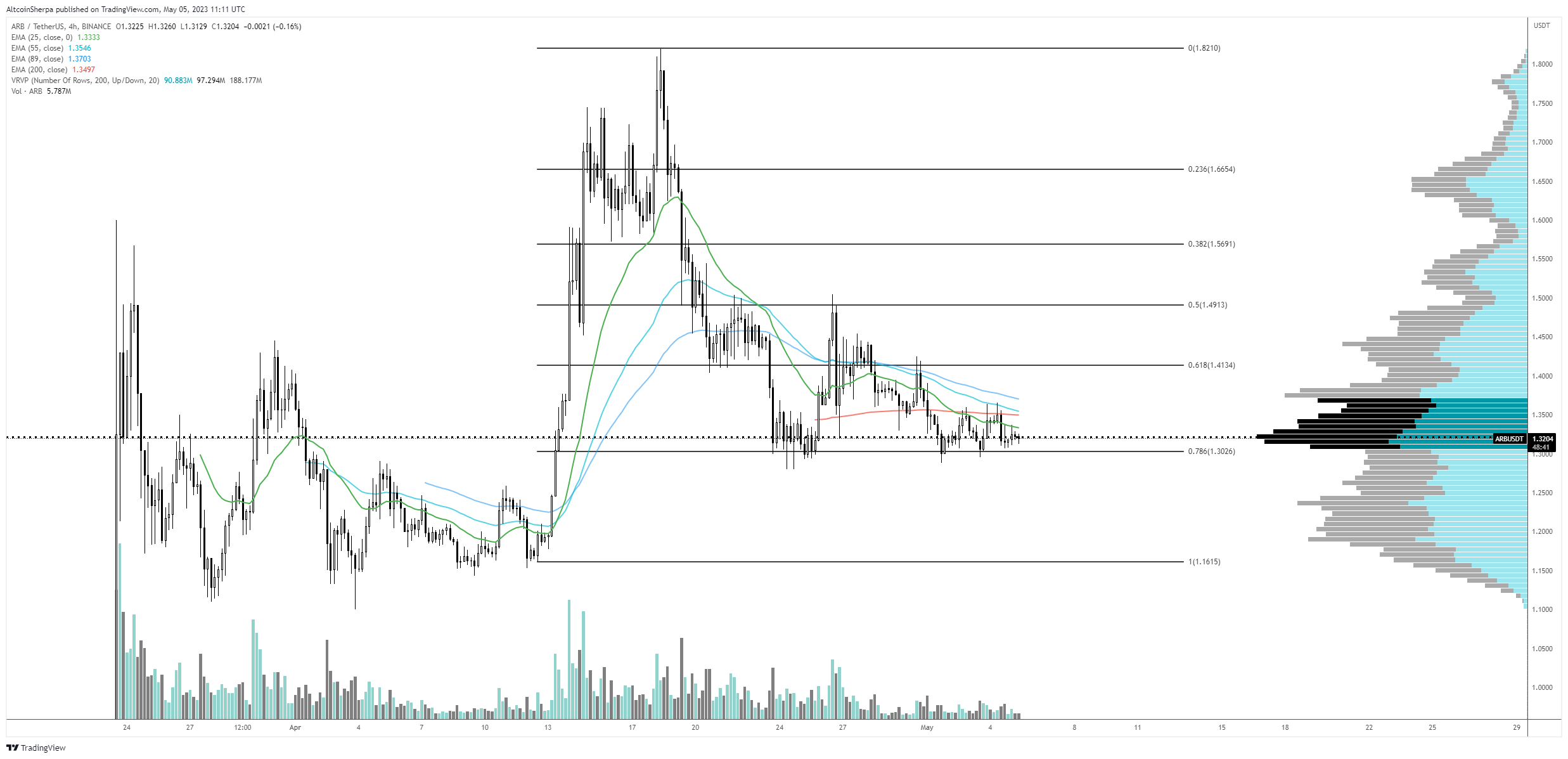

Lastly, Altcoin Sherpa looks at layer-2 scaling solution Arbitrum (ARB).

He predicts Aribitrum will dip lower by looking at several Exponential Moving Averages (EMAs) and the Fibonacci retracement levels. Traders look at the EMA to determine whether an asset’s price is in a downtrend. If the price is below the EMA, then the asset is likely going to remain bearish.

“ARB: Haven’t paid as much attention to this one lately, but I wouldn’t be surprised if it falls through and goes to the $1.15-$1.20 area again. This is still a great chain but new flavor of the month (SUI) + memecoin madness (PEPE) are sucking liquidity out of ‘normal’ coins.”

Arbitrum is worth $1.36 at time of writing, up 3% during the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Kartavaya Olya/Sol Invictus/monkographic

The post Top Trader Updates Outlook on Bitcoin and One New Ethereum Rival, Says This Crypto Asset Class Is Going to Zero appeared first on The Daily Hodl.