Ark Invest Report Reveals 70% of Circulating Bitcoin Supply Remains Unmoved for a Year

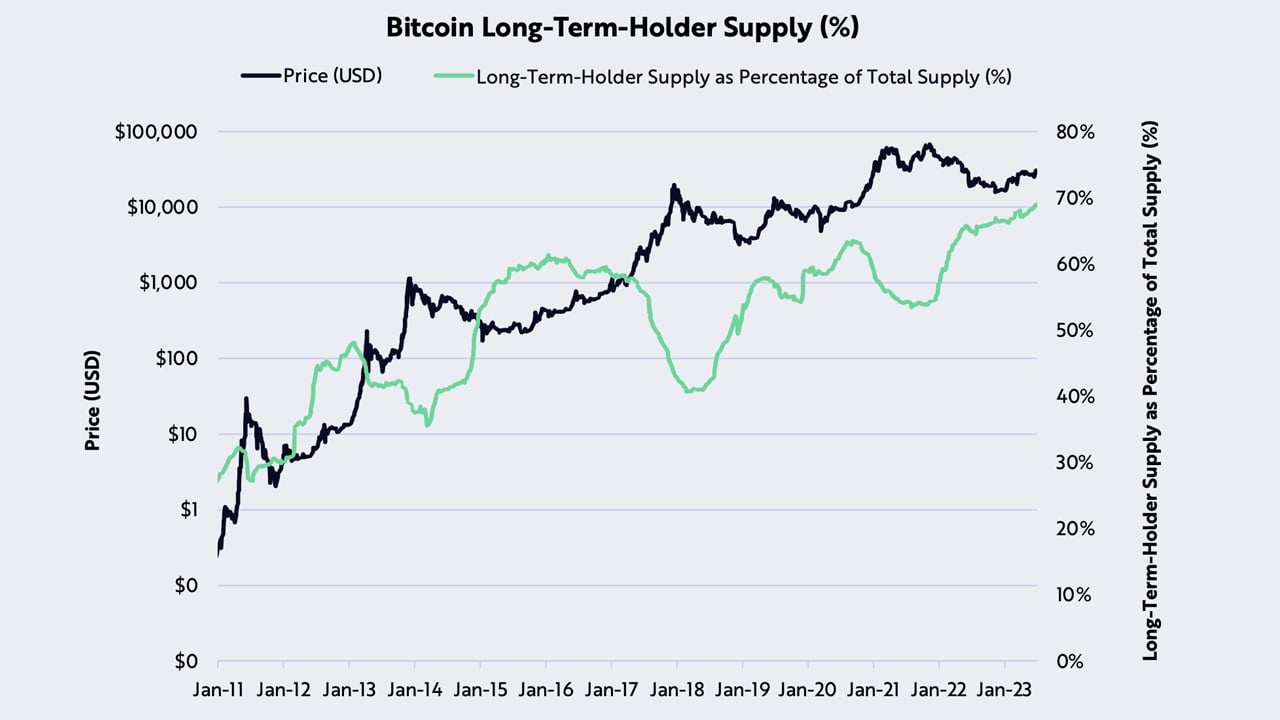

In a newly published report by the American investment management firm Ark Invest, the leading cryptocurrency, bitcoin (BTC), has found support from “strong holders and improved institutional sentiment.” Ark detailed that during the month of June, the supply of bitcoin that has not been moved for at least a year reached an all-time high of 70% of the current circulating supply.

Ark Invest Report Highlights Strong Bitcoin Holders and ‘Improved Institutional Sentiment’

Ark Invest, the investment firm that focuses on disruptive technologies, has published a report discussing bitcoin’s (BTC) recent momentum. The leading cryptocurrency has outpaced nearly every traditional asset during the first half of 2023, climbing more than 80% against the U.S. dollar.

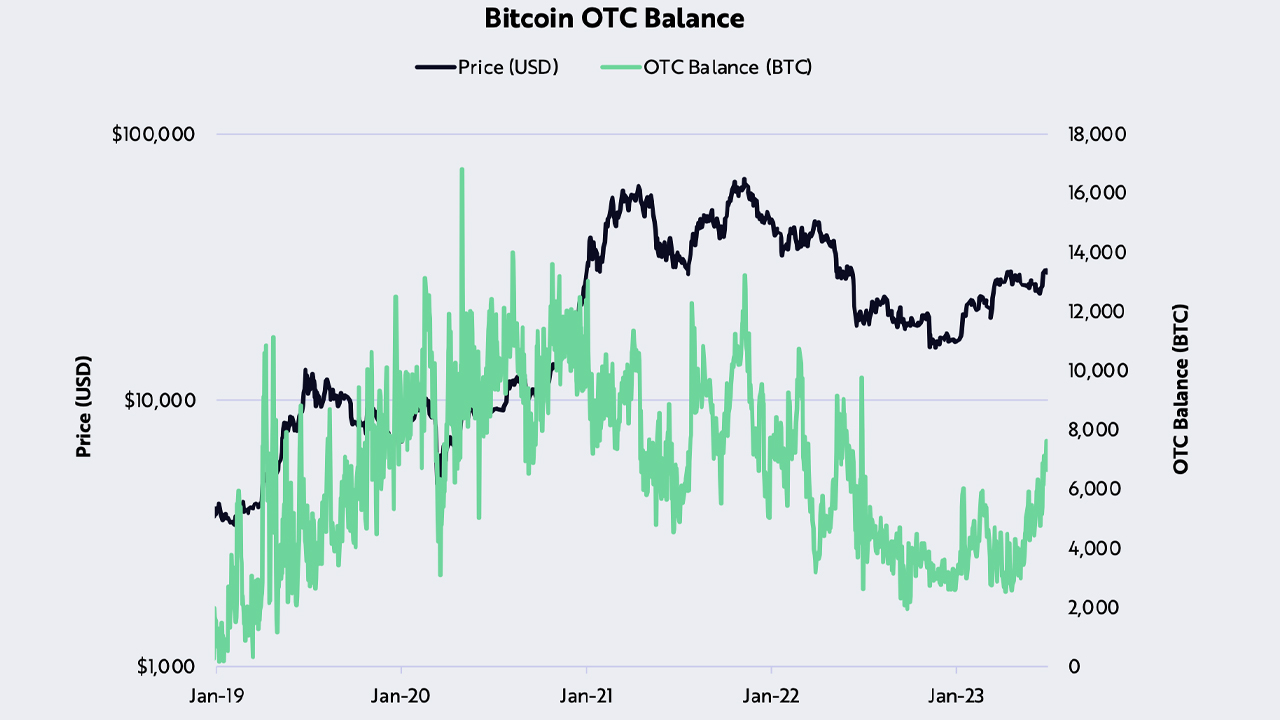

In the report, Ark Invest highlights the recent increase in institutional interest following the Blackrock spot bitcoin exchange-traded fund (ETF) filing. Ark’s researchers further explain that “the balance of bitcoin on [over-the-counter (OTC)] desks, a proxy for institutional activity, hit a one-year high.”

The report suggests that Grayscale’s GBTC rise in value indicates a potential shift in sentiment. Ark notes that the “increased balances on OTC desks suggest that institutions and other large capital allocators are focused increasingly on bitcoin.”

While institutional interest appears strong, Ark’s report also discusses how strong bitcoin holders have fortified the holder base. “Of the 19.4 million bitcoin in circulation, nearly 70% has not moved in at least one year or more, confirming a strengthening holder base,” Ark’s researchers explain.

The bullish signs for bitcoin are occurring amidst a tightening cycle that is “unprecedented in magnitude,” according to Ark’s report, which also touches on macroeconomic events. In the United States, Ark Invest’s researchers believe that fiscal and monetary policies are conflicting, and there are warning signals indicating a potential recession.

For example, Ark’s report says a contraction in new manufacturing orders suggests an impending recession. Despite the macroeconomic uncertainty, BTC has performed strongly, finding “strong technical support at its 200-week moving average, closing the month 14% above it,” as highlighted in Ark’s report.

What do you think the significant rise in strong holders and institutional interest means for bitcoin’s future? Share your thoughts and opinions about this subject in the comments section below.