Liquid Staking Derivatives in Ethereum Swell by 1.5 Million ETH in 2 Months

Over the course of the previous 63 days, there’s been a notable 16.98% surge in the quantity of ethereum (ETH) held in liquid staking derivatives protocols, with a substantial addition of roughly 1,507,285 ETH across 23 different platforms. Data reveals that Lido Finance dominates the market, commanding a 74% share of the liquid staked ether sector.

Influx of 1.5 Million Ether Bolsters Liquid Staking Derivatives Platforms

In a span of barely more than two months, the liquid staking derivatives sector witnessed a substantial swelling of nearly $3 billion in its value. Historical data from defillama.com, dated May 12, 2023, illustrates that an estimated 8.87 million ethereum (ETH) was held in liquid staking platforms. As of today, that number has ascended to a noteworthy 10.38 million ETH. Essentially, in the preceding 63-day window, there was an injection of 1.50 million ether, which translates to a monetary equivalent of approximately $2.96 billion, based on current ETH exchange rates.

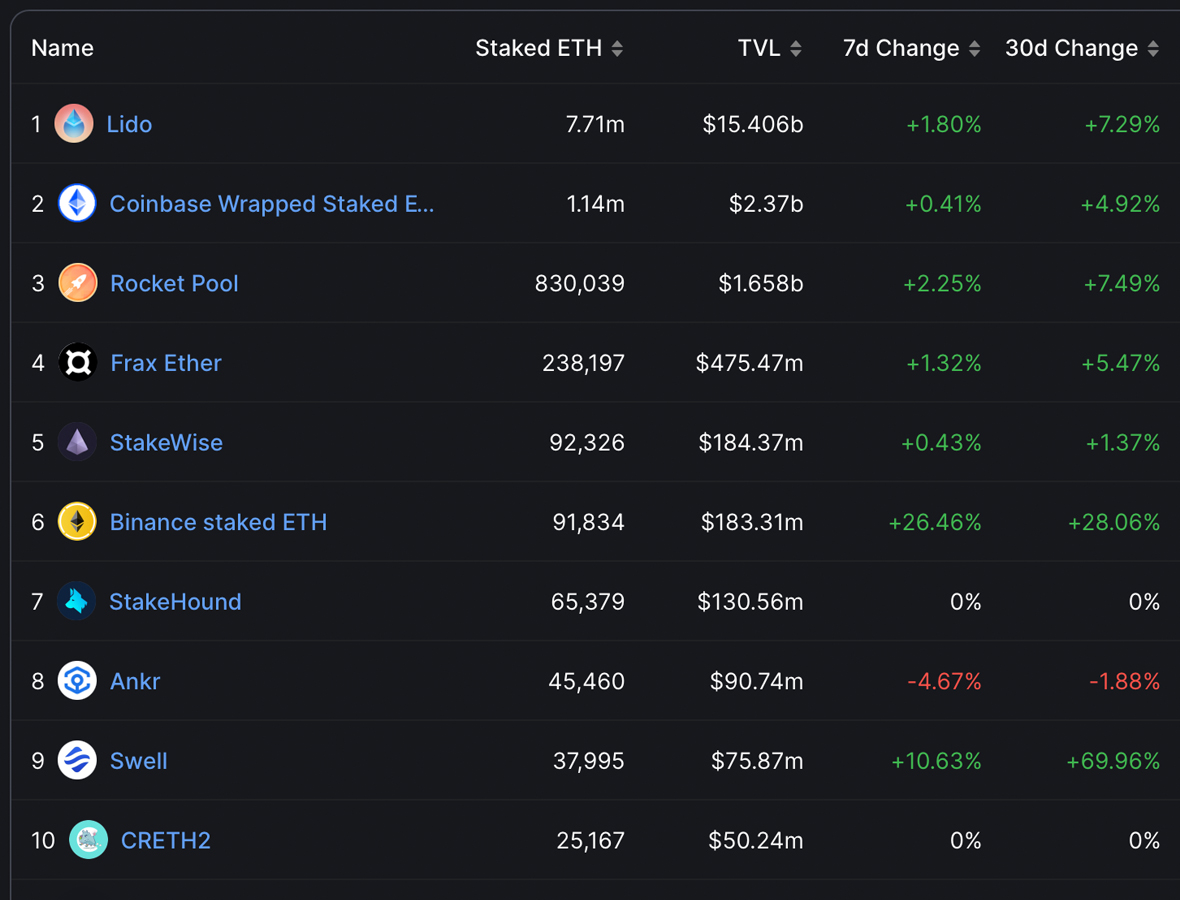

In the last week, the total value locked (TVL) in the liquid staking protocol Lido Finance has seen a marginal increase of 1.80%, and over the previous month, the TVL experienced a more significant jump of 7.29%. Of the 10.38 million ether distributed among 23 decentralized finance (defi) platforms, Lido retains an overwhelming 7.71 million ether, which makes up 74.33% of the total. Based on current exchange rates, Lido’s TVL is valued approximately at $15.406 billion. Following Lido, Coinbase’s Wrapped Ether protocol holds the second largest TVL, containing a substantial 1.14 million ether, currently valued at around $2.37 billion.

Data from May 12 suggests that Coinbase’s holdings were approximately 1.14 million ether, a figure that has seen little change to date. Conversely, Lido experienced a significant influx of about 1,113,098 ether added to its total value locked (TVL) in the 63-day period. This implies that since May 12, an estimated 394,187 ether was introduced into other liquid staking derivatives platforms excluding Lido and Coinbase. From this reported sum, Rocket Pool received a deposit of 207,406 ether. The Frax Ether protocol was the beneficiary of roughly 50,646 ETH, and Stakewise saw a modest increase with about 3,464 ether added.

On May 12, Binance’s Staked Ether protocol held 20,371 ether, a figure that has since surged to 91,834 ETH today. This signifies that during the past 63 days, a substantial 71,463 ether has been contributed to Binance’s Staked Ether protocol. Binance’s liquid staking derivatives platform ascended from being the ninth-largest ETH holder to the sixth-largest among the 23 liquid staking platforms. Monthly statistics reveal the platform experienced a 28.06% rise, but 26.46% of that growth occurred over the previous week. At present, the quantity of ether confined in liquid staking platforms constitutes 8.63% of the total circulating supply issued by the Ethereum network since its inception.

What do you think about the liquid staking derivatives platforms recording 1.5 million ether added over the past two months? Share your thoughts and opinions about this subject in the comments section below.