This Hedge Fund Manager Backs Bitcoin & Ethereum Prices to Keep Rising, with BTC20 Also Turning Heads

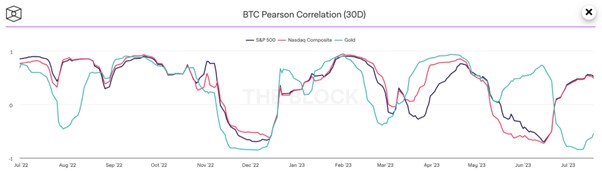

Cryptocurrencies are showing remarkable resilience amidst a turbulent economic environment, evidenced by their decoupling from traditional asset classes.

Dan Morehead, CEO of Pantera Capital, predicts this dynamic will allow major cryptos like Bitcoin and Ethereum to continue rallying over the medium term.

Although these two cryptos remain the most talked-about in the space, investors are also paying attention to BTC20 – an innovative new token that combines elements of both Bitcoin and Ethereum and has just launched an eagerly-anticipated presale phase.

Crypto Guru Dan Morehead Forecasts Rally for Bitcoin & Ethereum

Veteran hedge fund manager Dan Morehead has a long history of successfully investing in top cryptocurrencies before major price increases.

As CEO of Pantera Capital, a US-based hedge fund established in 2003, Morehead has managed a Bitcoin fund that has produced over 42,000% in returns since its inception.

Considering his background and successful track record, Morehead’s optimistic perspective on Bitcoin and Ethereum is highly influential in the crypto community.

In a recent interview with Forbes, Morehead stated that “we can rally now” in reference to the potential for the crypto market to recover after a difficult year in 2022.

This optimism stems from his interpretation of the Federal Reserve’s recent activity in the bond markets.

Over the past 15 years, the Fed has purchased huge amounts of bonds – a strategy known as “quantitative easing.”

According to Morehead, this aggressive monetary policy artificially suppressed yields, leading investors into the stock market.

However, now that the Fed’s quantitative easing is ending, stocks are expected to decline – yet Morehead highlights that blockchain assets have “massively decoupled” from the equity market.

This is due to the decentralized nature of cryptocurrencies, combined with their different value drivers relative to stocks.

As such, the crypto market is demonstrating resilience and not being affected as heavily as the stock market.

Consequently, cryptocurrencies can now trade based on their inherent value.

This dynamic is why Morehead is confident that Bitcoin and Ethereum will continue on an upward trajectory.

If crypto adoption continues growing, Morehead sees tremendous potential, even though price volatility remains high.

Could New Token BTC20 Pump Like Bitcoin & Ethereum?

BTC20 ($BTC20) has emerged as a standout candidate for those searching for high-potential alternatives to Bitcoin and Ethereum.

This new ERC-20 token is attracting attention for its unique blend of Bitcoin’s tokenomics and Ethereum’s advanced technology.

BTC20’s flagship feature is its stake-to-earn protocol, designed for investors seeking a passive income stream.

Operating on a Proof-of-Stake (PoS) consensus, this protocol is significantly less energy-intensive than Bitcoin mining, making it much more sustainable and environmentally friendly.

After BTC20’s presale concludes, a minimum of 14.95 million $BTC20 tokens will be locked into a staking contract and gradually enter circulation over an estimated 120 years.

Per BTC20’s whitepaper, this setup will ensure a consistent income stream for token holders.

Regarding the presale, BTC20’s team has ingeniously mirrored Bitcoin’s original supply from 2009.

A total of 6.05 million $BTC20 tokens will be offered during the presale, priced at $1 per token – a homage to when $BTC had the same price.

This enticing setup has attracted crypto enthusiasts and new investors alike, leading to a surge in members of the BTC20 Telegram community.

With the presale having already raised $144,000 in just two days, the buzz around BTC20 is beginning to grow – making it an exciting project to watch in the cryptocurrency space.

Disclaimer: The above article is sponsored content, and it’s written by a third-party, and is intended for promotional purposes only. It does not represent the opinions or the views of CryptoPotato, and nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post This Hedge Fund Manager Backs Bitcoin & Ethereum Prices to Keep Rising, with BTC20 Also Turning Heads appeared first on CryptoPotato.