End of Fed’s Tightening Cycle: Bernanke, Majority of Polled Economists See Terminal Rate Hike Ahead

With just a four-day window to go, the U.S. Federal Reserve appears primed to raise the federal funds rate by 25-basis-points (bps) at the forthcoming Federal Open Market Committee (FOMC) meeting scheduled for Wednesday. The market presently maintains the conviction that this quarter-point uptick is inevitable, and a group of 106 economists, according to a poll conducted by Reuters, are of the view that this will signify the concluding escalation of the ongoing tightening cycle.

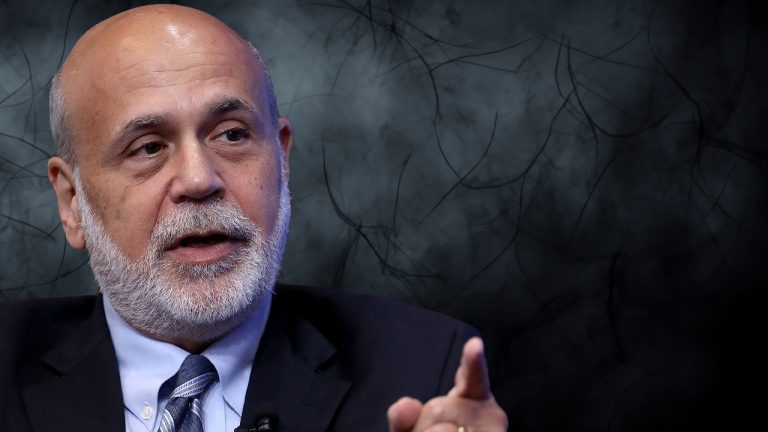

Former Fed Chair Ben Bernanke and Polled Economists Echo Anticipation of Final Federal Rate Hike

This Wednesday, all eyes are on the U.S. central bank as it stands on the threshold of a potential 25bps boost to the pivotal bank rate, pushing it to hover within the 5.25%-5.50% spectrum. The market has preemptively accepted the likelihood of this quarter-point advancement.

To illustrate, data from CME Group’s Fedwatch tool as of Saturday, July 22, 2023, signals a near-certain 99.2% probability of this 25bps escalation. On the other end of the spectrum, the same Fedwatch tool from CME conveys a relatively minuscule 0.8% chance for the rate to remain static.

Moreover, a survey published by Reuters on July 19, a majority of 106 economists suggest it will be the last federal funds rate increase for the tightening cycle. The poll’s participants surveyed between July 13-18 show that the perception that rates will remain high for a longer period of time has increased.

Jan Nevruzi, the U.S. rates strategist at Natwest Markets said that “despite the soft CPI print, we still anticipate a hike in July … (and) while we hope the softness in inflation persists, it is unwise from a policymaking standpoint to bank on that.” The Natwest strategist added:

We do not want to rush ahead and say the fight against inflation has been won, as we have seen head-fakes in the past.

Former Federal Reserve chair Ben Bernanke shares a similar view with the economists polled by Reuters. At a webinar event held by Fidelity Investments, Bernanke suggested that the 25bps rise in July could very well be the final hike. “It looks very clear that the Fed will raise another 25 basis points at its next meeting,” Bernanke said on Thursday. “It’s possible this increase in July might be the last one.”

The former central bank chair believes inflation will continue to drop and told investors he expects the inflation rate to range between 3% to 3.5%. While Bernanke acknowledged that the United States could see a slowdown in economic growth, he doesn’t envision a massive recession in the future.

“What we’ll see is a very modest increase in unemployment and a slowing of the economy,” Bernanke explained during the webinar. “But I’d be very surprised to see a deep recession in the next year.” While the Fed’s “dot-plot” shows the federal funds rate could reach 5.50%-5.75%, Reuters’ poll shows that only 19 economists out of the 106 surveyed suspect it will get that high.

How do you foresee the predicted final rate hike impacting the broader economy? Do you agree it’s the last one? Share your thoughts and opinions about this subject in the comments section below.