Bitcoin Lingers in a ‘Neutral’ Phase as the Fear and Greed Index Signals Market Consolidation

On Sunday, October 8, 2023, bitcoin’s price teeters just below the $28K threshold, marking a 2.6% rise from the previous week. Presently, the Crypto Fear and Greed Index (CFGI) hovers at a “neutral” 50 out of 100, a stance it’s held over the past week. Technical data reinforces this balanced outlook, indicating bitcoin’s price movement has nestled into a tighter band.

Bitcoin’s Tightrope Walk Continues While the Fear and Greed Index Reflects Undecided Sentiments

A week prior, bitcoin (BTC) was priced at $27,189 per unit. Over the past day, its value danced between $28,103 and $27,770. This week witnessed a 2.6% climb in bitcoin’s value, and it surged by 7.9% on a 30-day scale.

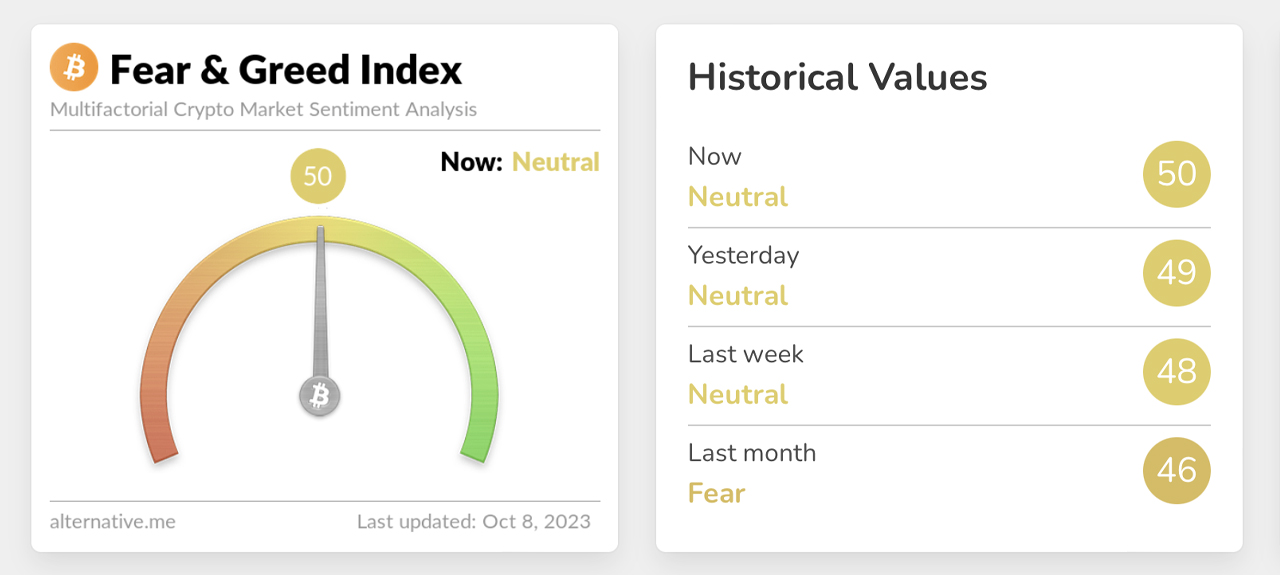

Throughout these fluctuations, the Crypto Fear and Greed Index (CFGI) has unswervingly projected its “neutral” position — not just today, but yesterday and the entire past week. In essence, the CFGI serves as a barometer, gauging the prevailing mood of the bitcoin marketplace. Its goal? To arm traders with insights into the collective psyche of market players.

The rationale being that overwhelming fear can depress prices too much, while rampant greed can inflate them excessively. By tapping into current sentiments, traders could pinpoint potential buy or sell moments. Interpreting the CFGI, one encounters phases like extreme fear, fear, neutral, greed, and extreme greed.

On October 8, 2023, alternative.me pegs the CFGI at 50, a slight rise from last week’s 48. Coinmarketcap.com’s “Fear and Greed” index echoes this sentiment, marking a neutral score of 46 on Sunday. With the market exhibiting such neutrality and bitcoin gravitating towards a more streamlined range, it’s evident the market remains indecisive.

Being neutral or ambivalent suggests the absence of a prevailing sentiment. It’s akin to a balance where neither pessimistic bears nor optimistic bulls command the market. However, neutrality doesn’t imply market stagnation. Prices may ebb and flow, but the index conveys a harmony between bullish and bearish forces.

Technical metrics for bitcoin, such as oscillators like the relative strength index (RSI) and stochastic (14, 3, 3), also exhibit this weekend’s neutral sentiment. When oscillators like the RSI and the stochastic (14, 3, 3) display neutrality, it signals that the asset is neither in an overbought nor oversold state.

With the current RSI around 61 and a stochastic reading near 75, there’s a balance between buy and sell pressures. Given these readings from both the oscillators and CFGI, it seems the market is poised in a consolidation phase, awaiting future cues or triggers.

What do you think about the Crypto Fear and Greed signals? Do you expect more consolidation? Share your thoughts and opinions about this subject in the comments section below.