Inflows Into Digital Asset Investment Products Cross the $1 Billion Mark — Study

The U.S. dollar value of funds flowing into digital asset investment products or exchange-traded products (ETP) in 2023 now exceeds $1 billion. In the week ending Nov. 10, approximately $293 million flowed into ETPs. Bitcoin ETP trading volumes in the week under review constituted nearly 20% of total bitcoin trading volumes on so-called trusted exchanges.

‘Third Highest Yearly Inflows on Record’

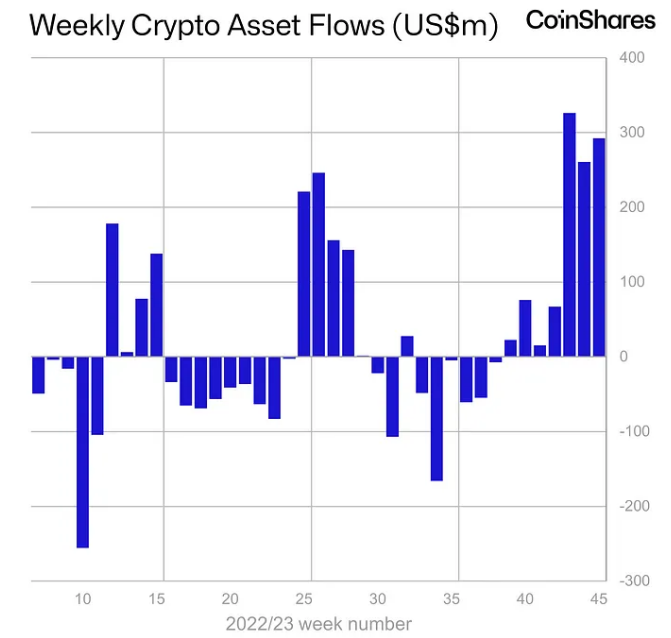

In the week ending on Nov. 10, the U.S. dollar value of funds flowing into digital asset investment products reached $293 million, the second-highest inflow in the year so far, the latest data from Coinshares has shown. As noted in Coinshares’ latest digital asset fund flows report, this new figure means the total value of funds that flowed into digital asset investment products has surpassed the $1 billion mark for the first time in 2023.

According to the report, “Digital asset investment products saw inflows totalling US$293m last week, bringing this 7-week run of inflows past the US$1bn mark, leaving year to date inflows at US$1.14bn, making it the third highest yearly inflows on record.” The total value of assets under management (AUM), on the other hand, rose by nearly ten per cent (9.6%) and “99% since the beginning of the year.”

The report, meanwhile, partly attributes the increase in the AUM to the recent crypto market rally which saw prices of digital assets like Solana (SOL), ETH, and even BTC go up by double-digit percentage figures. As indicated by the report, the AUM in week 45 stood at $44.3 billion, the highest since May 2022 when major crypto entities collapsed.

Growing Investor Appetite for Digital Asset Investment Products

As explained by the report, Bitcoin ETP trading volumes in the week under review constituted nearly 20% of total BTC trading volumes on the so-called trusted exchanges. According to the report, this unusual phenomenon may be an indication of growing investor appetites for digital asset investment products.

“This has rarely happened and suggests ETP investors are participating much more in this rally compared to 2020/21,” the report stated.

Concerning ETH, which recently rallied past $2,100, the Coinshares data indicates it may have seen some of the largest inflows since August 2022. Back then, the funds flowing into this crypto asset reached $49 million.

What are your thoughts on this story? Let us know what you think in the comments section below.