Ethereum Network Accounted for Over 90% of Layer 1 Revenues in Q3 — Study

According to a Messari report, the Ethereum network’s revenues constituted more than 90% of the $491.5 million generated by layer 1 chains in Q3. The data also shows that in the period in question, the Aptos network’s revenues were 160% higher than in the preceding quarter.

Ethereum Still Dominates

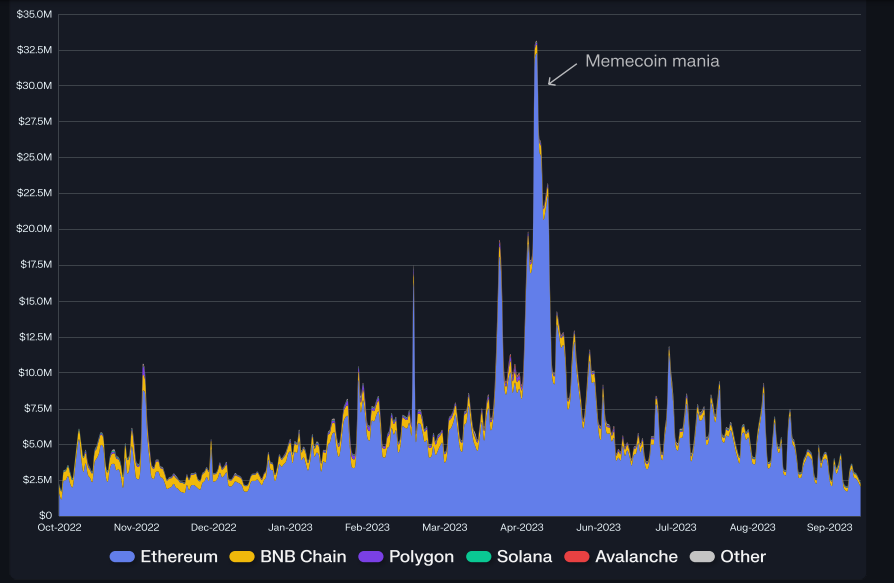

While the third quarter (Q3) revenue of the Ethereum network fell by 47.3% quarter-on-quarter (QoQ), it still accounted for nearly 91% of the total revenues generated by layer 1 (L1) protocols, data from the latest Messari study has shown. The data also shows the Avalanche (58.1%) and Polygon (55.6%) networks as the only other L1s which had steeper revenue drops than the Ethereum network.

According to the Messari report, the total revenues generated by the 17 L1s that were examined were 46.7% lower or $491.5 million less. During the same period, the market capitalization of all the L1s also dropped by 9.8% to close the quarter at $272.6 billion. The Ethereum network’s dominance in the period was largely unchanged, the report added.

However, as shown by the data, the Aptos and NEAR networks had better fortunes in the quarter than the other L1s. For instance, the data shows that in the period in question, the Aptos network’s revenues were 160% higher than in the preceding quarter. This spike in revenues is attributed to the protocol’s integration of the social media platform Chingari in early July.

On the other hand, the launch of the artificial intelligence (AI)-based lock screen platform Kaikainow is said to have fueled NEAR network’s “second highest revenue growth rate at

56%.”

Solana Has Most Average Daily Transactions

In terms of the number of average daily transactions (ADT), Solana had the most with 24.7 million followed by WAX with 17 million. The BNB Chain took the third spot with 3.5 million ADT while Polygon’s 2.3 million was enough for it to occupy the fourth spot. Despite accounting for a large chunk of the revenues, the Ethereum network’s transaction throughput of one million per day was only enough for the fifth position.

As shown by the data, SKALE saw the largest (241%) growth in the number of transactions in the period while NEAR had the biggest daily active address increase of 346%.

With respect to the total value locked (TVL) in decentralized finance, the data shows that this fell by 16.4% to $31.9 billion. From this total, the Ethereum network accounted for 82.4%.

What are your thoughts on this story? Let us know what you think in the comments section below.