Chainalysis Report Exposes: Majority of Pump-And-Dump Schemes End in Failure

Pump and dump schemes commonly entail an individual or a group of actors investing in a token, vigorously advocating for its value to surge, and then swiftly selling off their holdings for substantial gains. This frequently leads to a sharp drop or complete collapse in the token’s value, adversely affecting holders who were unaware of the manipulation.

Nevertheless, Chainalysis findings reveal a high failure rate of these schemes.

Pump-And-Dumps Plagued by High Failure Rate

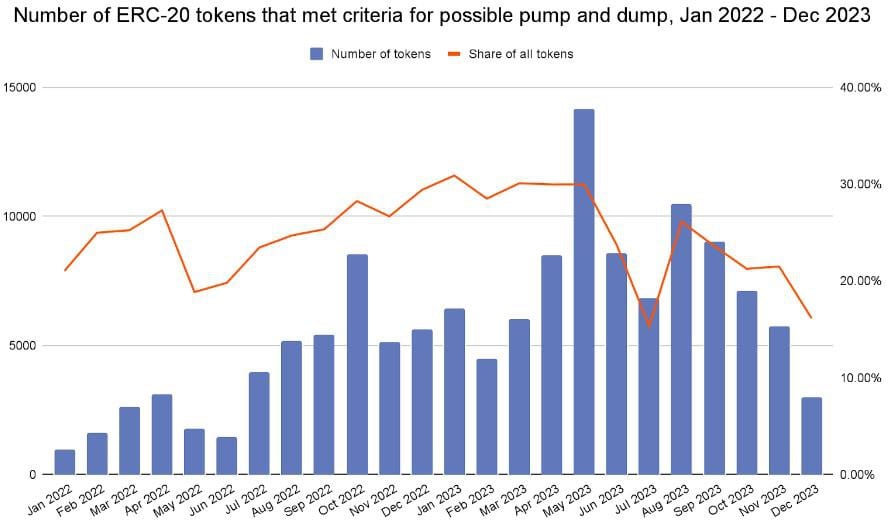

Chainalysis delved into pump-and-dump schemes and discovered that between January and December 2023, slightly over 370,000 tokens were introduced on Ethereum. Of these, around 168,600 were accessible for trading on at least one decentralized exchange (DEX).

Among those listed on DEXs, 54% met Chainalysis’s criteria, which is suggestive of potential market manipulation. In 2023, malicious entities collectively gained $241.6 million through these potentially unlawful schemes.

Interestingly, tokens meeting Chainalysis’ criteria yielded an average profit of just $2,672 each, constituting only 1.3% of Ethereum DEX trading volume for 2023, despite the substantial total profit amassed by these actors.

The data shared with CryptoPotato illustrates an ecosystem where bad actors could create tens of thousands of potential pump-and-dump tokens, most of which fail to generate significant profit or attract meaningful trading volume.

The blockchain analytics firm stated,

“Market manipulation, such as pump and dump schemes, are destructive to the crypto markets in the same way they are to traditional markets. However, cryptocurrency’s inherent transparency provides an opportunity to build safer markets. Market operators and government agencies can deploy monitoring tools that can help identify and prioritize areas for further investigation in a way that wouldn’t be possible in traditional markets.”

Shady Deals

Last year, Chainalysis identified that 24% of tokens introduced in 2022 exhibited traits indicative of pump-and-dump activities. It is safe to say that the crypto industry is swarmed with influencers who frequently engage in shady promotion deals without any level of transparency, causing harm to both projects and their supporters.

On-chain sleuth ZachXBT had recently targeted several popular crypto traders in a pump-and-dump scheme. The individuals in question – TraderNJ, PetaByte, XO, and Trader SZ – purportedly profited from the scheme’s gains while disregarding the interests of their followers.

ZachXBT had previously leveled similar allegations against popular crypto influencer Lark Davis as well as American YouTuber Logan Paul for allegedly promoting several pumps and dump schemes.

The post Chainalysis Report Exposes: Majority of Pump-And-Dump Schemes End in Failure appeared first on CryptoPotato.